Domestic Trade

QazTrade’s Activities in Domestic Trade

JSC “Center for Trade Policy Development “QazTrade” is a key analytical center for Kazakhstan’s trade sector. QazTrade systematically conducts research and analysis of the country’s trade industry.

Each year, QazTrade provides expert-analytical support to the Ministry of Trade and Integration of the Republic of Kazakhstan regarding the development of domestic trade. The following studies are conducted:

- Analysis of trade sector trends and development measures.

- Review of international best practices with localization for Kazakhstan.

- Legal review of trade laws and legislative improvements. Example: Law of April 2, 2019.

- Monthly monitoring of socially important food prices, causes of price growth, and regulatory improvements.

- Expert support for the State Commission on Emergency Situations, including COVID-19 policy and price ceilings.

- Dialogue platform for business and academia on trade development, including the National Distribution System and the 2021–2025 State Trade Development Program.

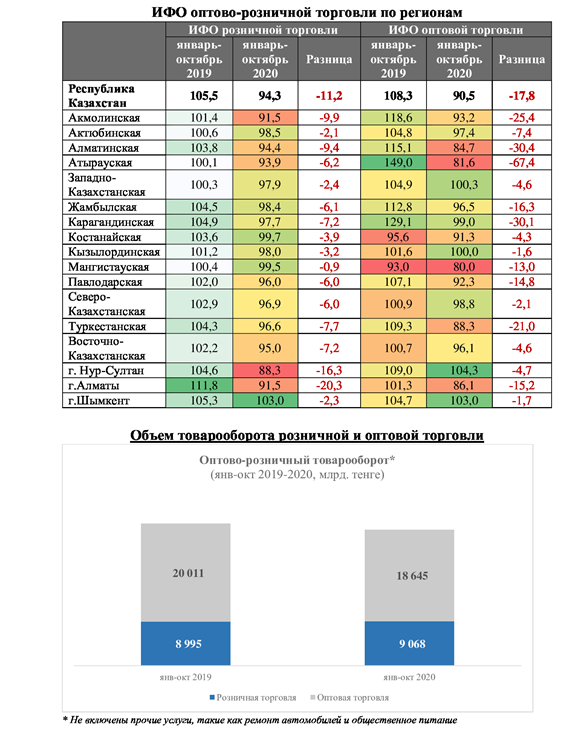

Main Indicators of Kazakhstan

Trade is a driver of economic growth. In 2019, domestic trade contributed 17% to GDP with 7.6% real growth.

Retail trade volume in 2019 was KZT 11,345.7 billion (+12.9% vs. 2018). Largest shares: Almaty (31.3%), Nur-Sultan (11.6%), East Kazakhstan (8.8%), Karaganda (8.7%).

Over 72.4% of retail turnover is held by SMEs: individual entrepreneurs (41.9%), small enterprises (30.5%).

Source: Statistics Committee of the Ministry of National Economy of RK

70% of turnover is in wholesale trade, mainly small-scale (87.3%).

Source: Statistics Committee of the Ministry of National Economy of RK

Global Experience and Current Status of Domestic Trade

Retail chains dominate global trade. In Kazakhstan, their share is only 31% versus 80%+ in developed countries.

Traditional stores and bazaars are widespread but have low productivity and lack innovation (e-commerce, cashier-free tech, Big Data).

Investments in trade are growing. In 2019, KZT 234.2 billion was invested (up KZT 18.2 billion vs. 2018).

Retail space per 1,000 people: 634 m² in Kazakhstan vs. 1,100–1,700 m² in the EU. Shortage of large-format modern retail centers.

This causes high rents and prices, which increase costs for retailers and consumers.

The shadow economy accounts for 51% of the gross value added in trade. Wholesale and retail dominate the informal sector.

Kazakhstan lacks modern wholesale markets and distribution hubs to efficiently channel domestic production.

Goods move through many inefficient intermediaries, increasing costs and losses.

There is an urgent need for modern trade-logistics infrastructure to ensure domestic producers access to markets.

Mobile trade is underdeveloped in Kazakhstan, despite success abroad in creating jobs and lowering prices through reduced rental costs.