Domestic trade

Domestic trade activities

JSC “Center for Development of Trade Policy” QazTrade “is a key analytical center for the trade industry in Kazakhstan. QazTrade systematically conducts work on the study and analysis of the trade industry in Kazakhstan.

Every year QazTrade provides expert and analytical support to the Ministry of Trade and Integration of the Republic of Kazakhstan on the development of internal trade. As part of this work, the following analytical studies are carried out.

- Analysis of the dynamics of the development of the trade industry, identification of new trends and development of measures for the development and support of subjects of internal trade.

Studying the best world experience in trade development, searching for the most interesting moments from foreign practice and developing recommendations for the implementation of these measures in Kazakhstan, taking into account local specifics.- Analysis of the current legislation of the Republic of Kazakhstan in the field of trade and development of proposals for its improvement. For example, with the active participation of QazTrade, the Law of the Republic of Kazakhstan “On Amendments and Additions to Certain Legislative Acts of the Republic of Kazakhstan on the Development of the Business Environment and Regulation of Trade Activities”, adopted on April 2, 2019, was developed.

Conducting monthly monitoring of prices for socially significant food products with a detailed analysis of the factors that influenced the rise in prices, as well as developing proposals for improving legislation on regulating and stabilizing prices for socially significant food products, including changes in the rules for calculating threshold values of retail prices for NWPT and the size of the maximum permissible retail prices for them.

This year, QazTrade provided expert and analytical support to the activities of the State Commission on ensuring the state of emergency under the President of the Republic of Kazakhstan, in particular, consultations were provided on the development of regulatory and legal acts to strengthen measures to prevent the spread of coronavirus infection in the Republic of Kazakhstan (restricting the operation of shopping facilities and etc.), on setting price caps for socially significant food products and on other issues.

QazTrade is a dialogue platform for holding meetings with representatives of the business community and academia to discuss and develop proposals for the development of the trade industry in Kazakhstan. This year, such issues as the formation of an organizational and business model of the National Commodity Distribution System, the development of the State Program for the Development of Trade in the Republic of Kazakhstan for 2021-2025, and the impact of COVID-19 on the activities of domestic trade entities were actively discussed.

Main characteristics

Trade is a driver of economic development and occupies one of the leading places in Kazakhstan’s GDP. At the end of 2019, the share of domestic trade in the structure of GDP was 17%, showing real growth of 7.6% per year.

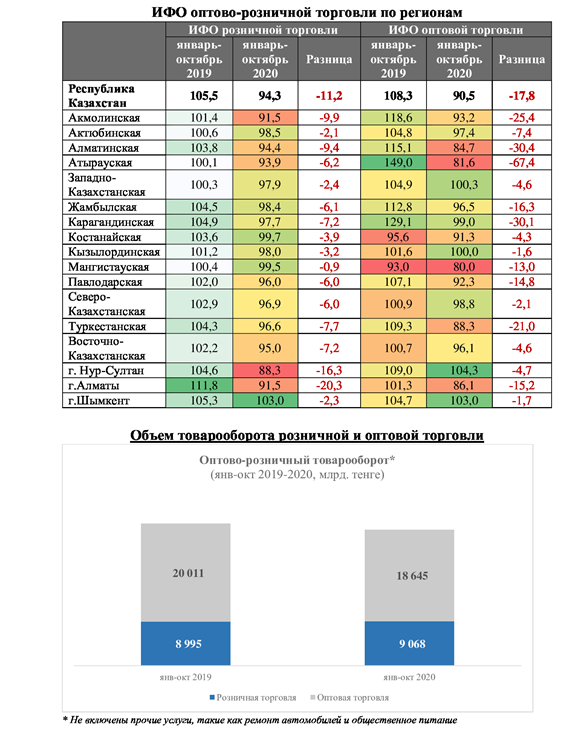

Against the background of an increase in demand, an increase in the nominal money income of the population, the index of the physical volume of retail trade in 2019 amounted to 105.8%, while the IFO of the wholesale trade was 108.2%.

Also, trade is the most important source of jobs in the country. At the end of 2019, the share of trade in employment amounted to 16.3%, that is, more than 1.4 million people are employed in this industry.

In general, in recent years, there has been a stable growth in domestic trade. At the end of 2019, the volume of retail and wholesale trade grew by 10.6% and amounted to 37.5 trillion. tenge.

The volume of retail trade in 2019 amounted to 11,345.7 billion tenge, which is 12.9% more than in the previous year. The largest share in the total retail trade of the republic in January-December 2019 falls on Almaty (31.3%), Nur-Sultan (11.6%), East Kazakhstan (8.8%) and Karaganda (8.7%) regions. More than half (72.4%) of retail turnover is concentrated in small businesses: individual entrepreneurs (41.9%), small businesses (30.5%).

Figure 1. Domestic trade (2013-2019), billion tenge

Source: KS MNE RK

At the same time, about 70% falls on wholesale trade, this is mainly a small wholesale (87.3%).

Figure 2. Structure of wholesale turnover,%

Source: KS MNE RK

World experience and the current situation of domestic trade in the Republic of Kazakhstan

Today, in the global retail trade, the role of network retailers as key players controlling sales markets is increasing.

According to Deloitte’s Global Retail Sector 2019 report, in 2017, the world’s 250 largest retailers achieved high growth rates with a turnover of 4.53 trillion. US dollars. The volume of the aggregate turnover is increasing every year. The largest retailers are companies from the USA, Germany and France, which is due to the extensive experience in the historical development of the retail business in these countries.

As a result, in the most developed countries the level of “retailization” reaches on average 80% of the entire retail food market, in Russia this figure has already reached 69%, in Belarus – 61%. While in Kazakhstan this level barely reached 31%.

Thus, modern trade formats in Kazakhstan, incl. retail trade networks are poorly developed. Most of the sales are carried out through small “convenience stores” that are not part of retail chains, or through bazaars. Only in the capital and Almaty in recent years, there has been a stable development of modern retail.

At the same time, traditional shops and bazaars are characterized by low labor productivity and an almost complete absence of the introduction of modern advanced technologies, such as Internet commerce, “cash desks without a seller”, BigData, etc.

The volume of investments in wholesale and retail trade is showing growth. At the end of 2019, investments in fixed assets in wholesale and retail trade amounted to 234.2 billion tenge, which in monetary terms is more by 18.2 billion tenge compared to the same period last year (216 billion tenge). At the same time, the IFO investment in trade amounted to 103.6%.

An important indicator of the development of trade is the provision of the population with retail space. In Kazakhstan, the provision of the population with retail space is only 634 sq. m. per 1000 people, while in the EU countries 1100-1700 sq. m. for 1000 people. A particularly high deficit is observed in modern retail space of large format categories 1 and 2 (over 2000 sq. M.). Thus, the area of large-format shopping facilities in Kazakhstan in 2018 amounted to 1,016 thousand square meters. m.

The shortage of retail space leads to inflated rental and buyout rates for retail space, which increases the costs of organizing retail business and ultimately leads to inflated prices for food and goods in these stores. The problem of relatively small volumes of construction and, accordingly, small volumes of supply of new retail space is associated, first of all, with the high cost of debt financing.

One of the significant problems in the trade sector is the high level of the non-observed (shadow) economy in trade. According to statistics, wholesale and retail trade over the past three years has occupied the largest share of the shadow economy in GDP, the volume of which reached 5.2 trillion tenge in 2018. Thus, about 51% of the GVA of all trade is in the shadow.

At the same time, Kazakhstan lacks a system of modern wholesale markets and wholesale distribution centers that can optimally accumulate and distribute the products of domestic producers.

The bulk of goods is sold in small wholesale through a large number of unproductive intermediaries. This leads to losses during transportation and storage, which are included in the cost of goods for the final consumer. Analysis of the distribution chain shows the presence of a large number of intermediaries for almost all groups of goods.

All these facts indicate the need to build an optimal trade and logistics infrastructure that will provide unhindered access for domestic producers to sales markets.

Also, such type of business as mobile trade is not developed in Kazakhstan. This type of business is successfully developing in foreign countries. This allows, on the one hand, to create a large number of jobs for small and medium-sized businesses, and, on the other hand, has an impact on reducing prices for the consumer. Prices in mobile retail are usually significantly lower than in stationary retail outlets due to savings in rent.