Flour Production: Potential for Increase in Exports

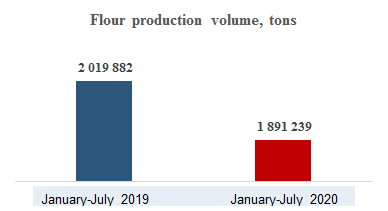

Production outputs for the period from January to July 2020 was 1.89 million tons of flour, which is 6.4% (2.019 million tons) lower than for the same period of 2019.

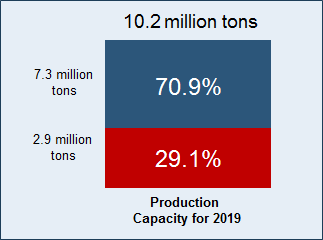

In 2019, production capacity was 10.2 million tons, but it was utilized by only 29% and 2.9 million tons of flour was produced. The potential flour output is 7 million tons, given that full capacity is utilized, which provides an opportunity for market expansion through export.

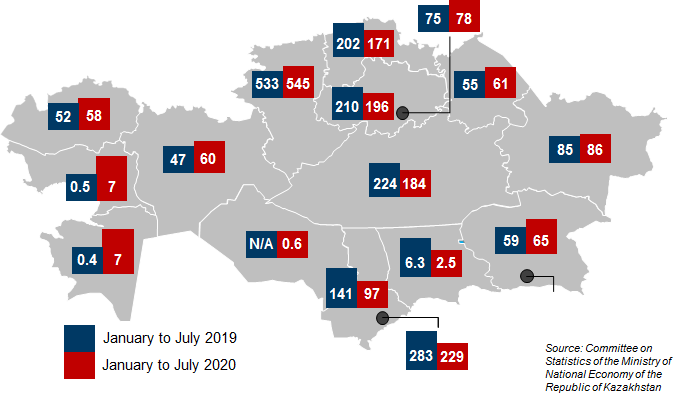

Production facilities of the flour-milling industry are located unevenly. E.g., only 5 regions account for over 70% of all production output: Akmola Region (10.4%), Karaganda Region (9.7%), Kostanay Region (28.8%), North Kazakhstan Region (9.0%), and Shymkent (12.1%). However, there is a decline in production observed in these grain-growing regions.

Mangistau and Atyrau regions show a 14-fold increase in production compared to the same period from January to July 2019. No production was not recorded in the Kyzylorda Region from January to July 2019.

Flour production outputs broken down by regions, thousand tons

Pasta Production: Potential for Increase in Exports

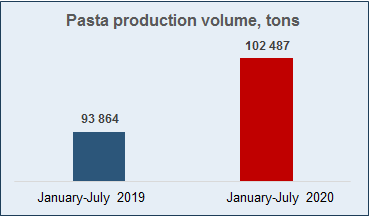

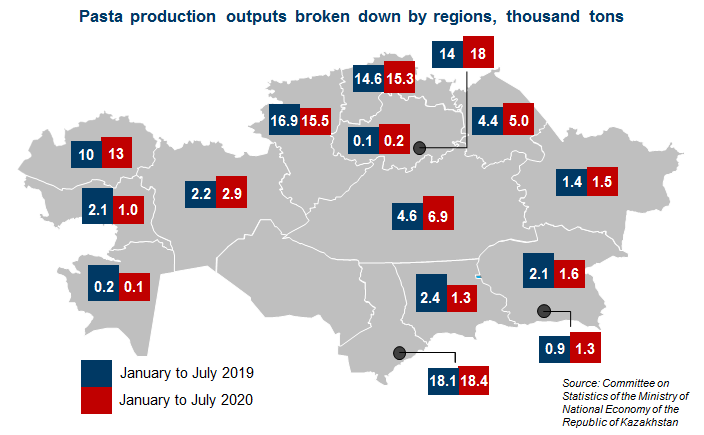

Production outputs for the period from January to July 2020 was 102 thousand tons of pasta, which is 9.1% (93.9 thousand tons) lower than for the same period of 2019.

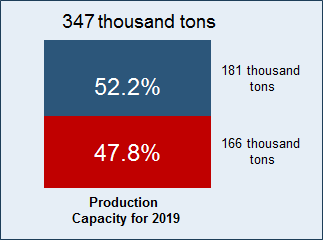

In 2019, production capacity was 347 thousand tons, but it was utilized only by 47.8% and 166 thousand tons of pasta was produced. The potential output is 181 thousand tons, given that full capacity is utilized, which provides an opportunity for market expansion through export.

Production capacity of the pasta industry is distributed across 5 regions, which account for about 79% of all output: Nur-Sultan and Shymkent cities (18%), Kostanay and North Kazakhstan regions (15%) and West Kazakhstan Region (13%). The main production facilities are concentrated mostly in the North of the country. No pasta production was recorded in Kyzylorda and Turkestan regions for the period from January to July in both 2019 and 2020.

Foreign Trade Balance and Return on Investment per One Tenge

Foreign trade balance coefficient for “flour” was 0.98, which is closer to 1, meaning that export exceeds import, or that volumes of imports are insignificant compared to exports. This coefficient implies huge potential for integration and increase in exports for this type of product, as well as high product quality. For “pasta,” index of competitiveness is 0.09, which means that there is a complete balance in foreign trade (the coefficient is closer to zero) that occurs when exports are equal to imports, and therefore, that foreign trade of this product is preformed under equal trade conditions and opportunities. The growth in exports of pasta products requires an increase in investment and modernization of production facilities to increase product quality.

Within this framework, this indicator reflects the growth in exports per unit of investment growth and is a criterion of flour export elasticity, and shows the dependence on the economic growth of flour production and on investment. Pasta export is a less investment-attractive industry and needs long-term financial support. In view of this indicator, flour production remains more attractive for both producers and investors compared to the production of pasta. However, given increased support and investment, the production of pasta has a high value chain.

Source: Calculations by JSC Center for Trade Policy Development “QazTrade”

Flour Production: Potential for Increase in Exports

From March 22 to June 1 of this year, Kazakhstan imposed bans and restrictions (quotas) for the export of flour, which were introduced due to the need to provide for national food security and due to an increased demand in the countries importing Kazakh products (Orders of the Ministry of Agriculture of the Republic of Kazakhstan No. 103 of March 22, 2020, and No. 111 of April 2, 2020).

Flour Production and Consumption Patterns, thousand tons

Average utilization of elevators is 35% to 40%. This indicates the high production capabilities of the common production processes utilized in the flour industry and the high potential for further production.

Challenges and Barriers for the Export of Pasta

Flour Trade Indicators: Exports

Since 2015, there has been a downward trend in flour exports from Kazakhstan: from $494 million to $363 million, or by 26.5%. At the same time, despite the restrictions imposed due to food security during the state of emergency, export of wheat flour showed an increase in total for 6 months of this year compared to the same period last year. Export of flour from Kazakhstan from January to June 2020 increased by 23.75% and was $198 million. It is worth noting that export earnings for flour have increased at a time when physical volumes have declined, indicating a spike in prices of this product.

The leaders in the export of wheat flour are Kostanay Region (37.4%) and Shymkent (18%). In 2019, a total of $201.1 million worth of products were exported from these two regions.North Kazakhstan, Akmola, Turkestan, Karaganda regions and Nur-Sultan are also major suppliers of wheat flour. They account for 35% of all exports, or $127.4 million. Three regions had no exports.

Flour Trade Indicators: Imports

In the first half of 2020, imports of wheat flour showed a significant increase (276.8%) compared to the same period last year and was $1.6 million. It is worth noting that flour is supplied to the domestic market at a high level among other commodity groups. Over the past year, flour import was less than 0.12% of the country’s production.

The main consumers of Kazakh flour are: Afghanistan with 61% ($221.4 million) and Uzbekistan with 21.2% ($76.9 million). Other major consumers are: Tajikistan with 5.3% ($19.3 million), Russia with 4.5% ($16.4 million), Turkmenistan with 2.9% ($10.4 million) and Kyrgyzstan with 2.6% ($9.6 million).

According to UN Comtrade, Kazakhstan’s flour supplies to the major importing countries account for an average of 90% of the total imports of these countries.

Developing Supplies of Pasta

The pasta market has a large scale in the world, total exports of pasta is about $8.7 billion. Meanwhile, the share of Kazakh products in the market is less than 0.2%. Considering the availability of high-quality components for the production of pasta in the domestic market (flour, water, other additives), Kazakhstan has a great potential for development in this industry.

The added value in the production of pasta is many times higher than the added value in the production of medium value added products (wheat flour) or the export of raw materials.

Kazakhstan produces a relatively large amount of pasta. Exports in 2019 were over $29 million. At the same time, exports of this commodity item account for 20% of production, which indicates a large potential output and increase in the export of pasta.

-Volume of exports of pasta has increased almost by 2 times over the past two years

-Main components for pasta production are widely available on the domestic market (flour, water, other additives)

Pasta Trade Indicators

Export supply of pasta in the period from January to June 2020 was $21.2 million, which is 58.2% more than in the same period of 2019. At the same time, there is a positive trend in the export of pasta over the past five years, from $10.6 million to $29.1 million (growth of 174.5%), which indicates an increase in the competitiveness of domestic products on foreign markets.

For the period from 2015 to 2019, imports of pasta showed a slight decrease of 6.3% from $41.5 million to $28.9 million. However, despite the restrictive measures caused by the COVID‑19 pandemic, imports of pasta in the first half of 2020 were at $17.9 million, which is 15.5% more than in the same period of 2019 ($15.5 million).

Potential for Increase in Exports to PRC

China’s pasta consumption has grown by an average of 6% over the past three years, with import growth rates of 9% from 2017 to 2019. However, it is necessary to increase production for export to China, given that the share of exports to China in the total exports of Kazakhstan is less than 1%. E.g., in 2019, 370 tons of products were exported. Given the capacity of the Chinese market and the production capacity of the Republic of Kazakhstan, it is crucial that domestic companies examine this market.

With effective investment in the pasta industry, there is a potential for additional utilization of production facilities, while also taking care of domestic consumption (sales on the domestic market in 2019 were 153 thousand tons). Taking into account the growth estimated by the expert community, the average growth of pasta consumption in Kazakhstan in recent years was 13%. Keeping these factors in mind, there are three scenarios of additional utilization of production facilities for the potential pasta output given utilization of 47% or 166 thousand tons of products (average export value is $665 per ton of products). Also, entering Chinese markets requires modernization of production facilities, expansion of the variety of pasta products, adjustment of technological processes to meet the needs of China, and enhancing support measures.

Scenario 1: with additional 10% utilization of production capacity, export growth will be $16.5 million or 56 percent.

Scenario 2: with additional 20% utilization of production capacity, export growth will be $39.7 million or 1.37 times higher.

Scenario 3: with additional 30% utilization of production capacity, export growth will be $62.8 million or 2.1 times higher.

Source: Calculations by JSC Center for Trade Policy Development “QazTrade”

Pasta Trade Indicators

Export of Pasta by Regions of the Republic of Kazakhstan for 2019

The leaders in the export of pasta products are Almaty (33.7%), Kostanay (13.4%) and Pavlodar (12.2%) regions. In 2019, a total of $17.2 million worth of products were exported from these three regions. West Kazakhstan, North Kazakhstan, and Karaganda regions, Almaty, and Shymkent are also major suppliers of pasta products. They account for 36.8% of all exports, or $10.7 million. No exports were observed in the Kyzylorda Region.

Challenges and Barriers for the Export of Pasta

Unified Export Basket for 2020 (January to June). Pasta

| Consumers of Pasta from Kazakhstan and Russia | Kazakhstan’s Output from Jan to June 2020, thousand $ | Russia’s Output from Jan to June 2020, thousand $ | Total Growth/Loss, thousand $ | Total Exports in 2020, thousand $ | Annual Demand, million $ Potential for Growth |

| AZERBAIJAN | 1,917.3 | 583.9 | 1,917 | 11.1 | |

| AFGHANISTAN | 300.6 | -342.2 | 300 | 1.1 | |

| BANGLADESH | 0.9 | 0.9 | 1 | 0.1 | |

| BULGARIA | 98.4 | -23.4 | 98 | 14.0 | |

| GERMANY | 205.7 | 83.9 | 206 | 791.3 | |

| GEORGIA | 473.5 | 4,132.3 | 926.5 | 4,606 | 12.3 |

| ISRAEL | 225.4 | 33.7 | 225 | 56.1 | |

| CHINA | 155.3 | 370.1 | 182.6 | 525 | 282.5 |

| LATVIA | 344.4 | 33.7 | 344 | 14.5 | |

| LITHUANIA | 261.6 | 37.2 | 262 | 19.5 | |

| MOLDOVA | 14.4 | 1,087.8 | 257.1 | 1,102 | 4.6 |

| MONGOLIA | 94.8 | 1,387.2 | -556.7 | 1,482 | 24.4 |

| USA | 239.4 | 151 | 239 | 1,017.1 | |

| TAJIKISTAN | 4,422.5 | 1,452.5 | 1,059.5 | 5,875 | 13.3 |

| TURKMENISTAN | 1,904.7 | 946.6 | 815.1 | 2,851 | 4.4 |

| UZBEKISTAN | 5,076.6 | 2,933.5 | 3,155 | 8,010 | 12.1 |

| UKRAINE | 3,174.3 | 404.4 | 3,174 | 41.1 |

•Creation of joint ventures to increase product value added 1 level higher

•Supply to the Afghan market with optimal logistics calculations

•Attracting investment •Creating regional brands through joint ventures

•Joint lobbying of foreign markets

Container Transportation for Export of Agricultural Products

According to JSC NC “Kazakhstan Temir Zholy”, in 2020, Kazakhstan introduced reduction coefficients to the maximum level of tariffs for services of the main railway network and locomotive traction when transporting grain and leguminous crops, and products of the flour-milling and cereal industry in containers through the stations of Aktau, Kuryk, Altynkol, Dostyk, Saryagash, Bolashak, Oazis and Lugovaya.

Also, to support Kazakh producers during the pandemic, JSC NC “KTZ” canceled the 10-fold fee for storage of goods that are idle for more than 48 hours until the end of the year. Under the Istanbul Convention, the period for temporary importation of containers was increased to 180 days.

Advantages of Container Transportation

-Loading options at the elevator and grain storage sites (in barns);

-Transportation over longer distances;

-Transportation at a higher speed, “end-to-end”, and without the need for transferring cargo while en route;

-Safety of cargo

SWOT Analysis for the Development of Flour-Milling

Industry in the Republic of Kazakhstan

Analysis of the Instant Noodles Market

Imports of instant noodles for the period from January to June 2020 was $4,592 thousand, which is 18% higher than for the same period in 2019. If from January to June 2019 the balance was -$497 thousand, from January to June 2020 the balance now was -$1,592 thousand. From January to June 2020, $3 million worth of products was exported, which is 11.3% lower for the same period in 2019.

According to the World Instant Noodles Association (WINA), the volume of consumption in Kazakhstan in 2019 was 250 million servings. The main consumers of noodles are China, Indonesia, India, Japan and Vietnam, which account for 67% of global consumption. Kazakhstan ranks 28th with a share of 0.2% of total consumption in the world.

An important competitive advantage of the domestic product is that the cost of fast noodles in Kazakhstan is 60% lower than in China. At the same time, the production of fast noodles is considered more difficult and more expensive than the production of pasta due to the need for large investments in the production line, equipment and the selection of highly qualified personnel.